INTRODUCTION

It has become increasingly important for companies to keep track of the extent, quality, and use of their intangible assets. It has become equally important to have processes and procedures in place to create, inventory, perfect, and use intellectual property (IP) rights associated with those assets. Not only is this critical from an operational, performance and competitive standpoint, but investors and creditors must have a reliable mechanism to determine ownership, scope, and status of the intellectual property rights - the backbone of most corporate value these days.

A majority of executives believes that focusing on short-term results inhibits the development of sophisticated processes for managing intellectual property. A majority of executives also believes that intellectual property management is too often treated as a purely legal issue at the expense of the larger-picture business strategy. Since companies already have docketing systems in place (in-house or through outside counsel) to handle the classic legal issues, the longer-term, more strategic issues are put off. The focus on short-term results causes intellectual property, and related corporate performance, to remain somewhat behind.

It is also simply the case that if you don’t know what you’ve got, you won’t know what you’re missing. This is important not only in terms of improving the management of intellectual property and accounting for it, but in a world where misappropriation of trade secrets and other IP assets is rampant, basic and instantly accessible inventories are crucial. Corporate leaders face increased risks of liability from their own shareholders for wasting, exposing and losing key assets.

Given the reality of an increasingly competitive world fueled by rapid innovation, greater corporate awareness of these dynamics is putting intellectual property closer to the center of the table.

WHY IS AN INTELLECTUAL PROPERTY AUDIT IMPORTANT? HOW CAN IT HELP?

There are several reasons for conducting an IP audit. Some are strategic and some necessitated by particular events (discussed in greater length below). In either case, just as a tree can seem healthy by virtue of its living leaves and fruit yet be hollowing and supported by an unhealthy root system, so too can any company be withering without much awareness until it’s too late. An IP audit can expose weaknesses – as well as strengths. A company can choose to focus on either, or both.

In addition, intellectual property is a wealth driver in the post-industrial information economy. Focused attention on IP identification and management builds current and future corporate value. An aggressive and vigilant approach to IP will help ensure investor confidence. Coordination of IP protection with appropriate and well-timed public disclosures will also help position a company as a leader in its field. A company is also more likely to maximize revenue streams derived from innovation if they maintain awareness and repeatable processes around their intellectual property.

It also makes little sense to have a company strategy with supporting goals and tactics, and an unconnected approach to the IP that drives its value. Companies collectively spend millions of dollars tracking and managing their tangible assets: inventory, work in progress, real estate, equipment, computers, and so on — millions of dollars to manage just 15% or so of their corporate value.1 As with tangible assets, intellectual property has to be identified, protected, and well managed. Arguably it is more important to take these steps with intellectual property assets as they account for a disproportionate share of a company’s value.

The common denominator is that intellectual property should be viewed and treated as a valuable business asset, not just a collection of legal rights that only lawyers care about. An intellectual property audit (or assessment) is frequently the first step on the path toward aligning IP strategy with business strategy. It should be undertaken with that context in mind. Generally speaking, it is an inspection of the intellectual property owned, used or acquired by a business as well as a review of its management, maintenance, exploitation, and enforcement. An IP audit is also the process through which a company understands the breadth and depth of the intellectual property assets it owns or controls. It facilitates a greater understanding of how these assets relate to the core business. As importantly, the audit uncovers assets that do not contribute to the financial well-being of the company and unnecessarily consume valuable corporate resources. Depending on the scope of the audit, it may also include a look at embryonic ideas and ongoing innovation. In other words, the audit can identify and inventory potential intellectual property. This in turn can lead to improved innovation management processes and revelation of hidden value.

In addition to simply an inventory, the intellectual property audit helps to quantify the value of the intangible assets to the extent that such value depends on the legal rights supporting those assets. The audit examines and evaluates the strengths and weaknesses in the procedures used to protect each intangible asset and secure appropriate intellectual property rights.

Where necessary, the audit provides tools to develop additional processes, take corrective measures to help ensure that future intellectual property rights are captured and third-party rights are accounted for, and manage IP in real-time with greater speed and efficiency.

1. See Ocean Tomo 2015 Annual Study of Intangible Asset Market Value: http://www.oceantomo.com//blog/2015/03-05-ocean-tomo-2015-intangible-asset-market-value/

WHAT WILL AN INTELLECTUAL PROPERTY AUDIT PRODUCE?

The short answer is that an IP audit can reveal opportunities to save money, create new revenues, increase efficiencies and improve competitiveness.

IP audits will vary depending on the need. Still, it is instructive to understand the output of a comprehensive audit. With such an understanding, one can then more knowledgeably implement in phases or choose particular portions.

Phases can be asset-specific. For example, some types of companies such as those in the creative arts may be more heavily copyright-driven and thus may wish to narrow the scope of an audit to copyrights and related issues. Here it is worth keeping in mind that the various forms of intellectual property protection are not mutually exclusive. They can exist together in strategically sensible ways: Patents to protect inventive ideas (e.g., new chemical compounds); copyrights to protect the originality of how ideas are expressed (e.g., software source code, brochures, books or songs); trademarks to protect the value of something that indicates the source of a product or service (e.g., a logo, tagline or product name); and trade secrets to protect competitive confidential information. Many organizations are not as sensitive or trained as they should be regarding the effectiveness of a “belt and suspenders” approach to IP protection. For example, computer source code can produce results that are worthy of a strong brand (backed by a trademark) and be registered as copyrights while redacting trade secret portions; a new product can be protected with a patent while its related manufacturing process can be held back as a trade secret; Patented products or processes that are well-branded can also be protected with trademarks and just the brands licensed out to other lines of business. An intellectual property audit can reveal areas where there are or could be overlapping protection and monetization opportunities.

Phases can also build upon one another. For example, a Phase 1 IP audit can predominantly relate to identification issues, the output being an inventory of IP (“what do we have?”), gaps in coverage, and suggested remedial measures. Such an audit can reveal enough information (what’s pending, what’s issued, in what geographic regions, for how long, etc) to enable leaders to manage an existing portfolio more efficiently and strategically. Such an “identification” audit can also represent the due diligence required for:

- Business combinations (mergers; acquisitions)

- Proposed joint ventures or other partnership arrangements

- Lender or investment requirements

- Regulatory compliance

- Litigation

A Phase 2 audit can build on that and address the company’s IP from a “protection and preservation” standpoint. It can comprehensively assess every process and procedure to create, protect and leverage intellectual property. The intent would be to uncover and suggest actions that would maximize the exploitation and value of the company’s intellectual property. Such a review can cover activities related to:

- Innovation and invention disclosure efficiencies

- Risk areas such as:

- Cleanroom practices (e.g., separation of specification and coding personnel to mitigate copyright and other infringement claims

- Physical site security

- Data security

- Employee and contractor intake and exit policies, procedures and documentation

- Training

- Coordination with other office locations, operating companies, etc.

- Cross-function coordination (connecting various disciplines)

- Optimization of reporting (to a board, management, shareholders, lenders, etc)

- International issues

- Legislative, regulatory and judicial issues

- Valuations

A good audit – one that is complete – will also take into account the IP lifecycle. This refers to IP at various stages as well as IP that is created both from inside the corporate entity - and outside. Areas to look at concerning externally created IP include:

- In the case of early-stage companies, pre-formation activities by founders and early hires

- IP that is accessed by contract or license

- IP that is owned by way of acquisition or merger

- Joint ventures, partnerships or other “open innovation” activities

Areas to look at concerning internally created IP include most of the points above as well as a deeper look at the scope and timing of employee assignment, nondisclosure, nonsolicitation and, where permitted by law, noncompete obligations in addition to other “infrastructure” issues.

Areas to look at in terms of various stages of intellectual property include:

- Ongoing research & development; the idea stage or “potential IP;”

- The status of pending applications and issued IP rights for all asset classes (patents, copyrights, trademarks, trade secrets);

- Commercialization and licensing

At the end of an intellectual property audit, the company will have a detailed understanding of its IP profile at this single point in time—an IP snapshot, as well as a better sense of existing risks, deficiencies, gaps, areas and processes ripe for improvement, and, as importantly – strengths. Depending on the nature of the particular audit, the resulting report may cover:

- Inventory issues. A catalog of issued, pending and potential intellectual property assets, including invention disclosures, patents, trademarks, copyrights and trade secrets.

- Timing issues. An understanding of any time sensitive matters such as filing deadlines and best practices regarding public disclosures and usage.

- Ownership issues. Does the company have clear ownership over these assets? Are there proper assignments in place? What is the scope of its rights? Are there securitizations/collateralizations? Government reachback rights? Joint rights? Copyright termination rights?

- Maintenance issues. Are maintenance fees (annuities) being timely paid? Are products being marked properly? Are trademarks being properly used? Are trade secrets being reasonably protected? Have there been Customs and Border Patrol registrations? Are royalties being collected and paid as required?

- Liability issues. Is the company making appropriate use of IP rights? Is there a process for monitoring possible infringement of the company’s IP?

- Commercialization issues. How is the company’s IP deployed? How is it generating revenue? Is it dependent upon certain license agreements?

- Strategic issues. Are these assets being properly managed and exploited in alignment with the strategic objectives of the company? Are there restrictions to their use? Does the company lack certain IP rights that it needs in order to build a new product?

Following an intellectual property audit, management maps its newly established inventory of IP assets, related issues, and opportunities to its strategic business objectives. This mapping exercise helps determine what actions should be taken in response to the audit findings. One approach to this mapping could be to divide the findings into two groups:

1. Assets or innovation activities that are important for current or future business of the company

2. Assets of little or no value to the owning company

In the first group, the company may have a collection of techniques, innovations, and ideas that are essential to the current and future products, services and markets the company competes in. The company may find patents that competitors infringe and may seek royalty payments, cross-licenses or defensively keep those competitors out of its markets. The company may also discover the need to improve its innovation productivity to ensure continuity as patents near the end of their life.

In the second group, a company may find that it is paying to maintain a significant number of assets that are not relevant to its core business. Such patents could be abandoned, sold, donated or licensed for the financial benefit of the company by way of cost savings or new lines of revenue – or optimally both.

As you can imagine, the results of the IP audit may add a new dimension to strategy discussions for both intellectual property and the business as a whole.

WHEN TO DO AN INTELLECTUAL PROPERTY AUDIT

Dow Chemical decided in the early 1990s to map its IP portfolio and specifically to audit its patent holdings. They had about 29,000 patents. What they discovered was that many were either not being used or were insignificant to the core business. They stopped maintaining underutilized or wasting patents and saved $5 million a year in renewal fees. They sold 77 patents and made in excess of $100M. And they created a licensing program that turned into a $250 million business. There is not really a bad time to conduct an IP audit – for large and small companies alike.

It is also never too early to conduct an intellectual property audit. There is a common misconception that a company must be relatively mature or possess a formidable portfolio of IP assets before it is time for an audit. Even pre-revenue start-ups would do well to demonstrate a serious and sophisticated approach to managing their IP. This would include, from an audit standpoint, a clear understanding of the myriad nondisclosure and invention assignment agreements they tend to have in the early days. It would boost the confidence of funding sources such as angel or venture investors, and help ensure that any gaps are closed. In one audit of a startup, it was revealed that while they filed some trademark applications in the U.S. and across Europe, they intended to do business in South America yet overlooked it for trademark protection. That same company discovered after an audit that a key patent application was in danger of abandonment for lack of communication from a foreign patent agent.

Still, the overall importance of intellectual property assets to the business will have a bearing on the nature and timing of the audit. When such assets are relatively unimportant to the nature of the business as a whole, it might be sufficient merely to confirm that registered IP rights are in good standing and are held in the name of the company. Alternatively, when the company’s principal business is heavily dependent on intellectual property or when pressure builds to optimize resource allocation and trim budgets, it may be necessary to conduct a more thorough assessment of the company’s IP portfolio and IP-based activities.

Further, particular events can create the need to perform an IP audit. Such events could include:

- Acquisitions or mergers

- Divestitures

- Investments

- Company reorganization

- Regulatory requirements

- New asset transfer and tax strategies

- Debt and related activities

- Key knowledge workers, IP managers or others with access to sensitive information leaving the company

- Winding down or corporate restructuring

- Litigation

With specific reference to litigation, it is often the case especially in patent litigation that settlement or trial results come down to a battle of valuation experts. Such experts rely upon internal company data related to costs and sales of goods or services containing the patented technologies in question, among other things. Quick-fire audits may be necessary in order to cross-reference such data. Also in the world of dispute resolution, if your company is the target of a lawsuit or cease and desist communication, the first order of business is to batten down the hatches. IP audits help to locate those “hatches,” for example, lists of assets including trade secrets, and flows of confidential IP-related communications – including attorney-client privileged communications.

HOW TO DO AN INTELLECTUAL PROPERTY AUDIT

There are myriad resources available for IP audits. One need only search the internet to find various checklists, explanations and approaches. This is but one of many and is representative in nature; i.e., it is not necessarily complete.

As mentioned, an IP audit can be done in phases or with limited scope. The key is alignment of expectations and constant communication to ensure a successful outcome. For most intellectual property audits, a written plan should be prepared in advance. Beyond schedule and cost, the plan should define the objectives and scope of the audit, areas of inquiry, and responsible parties. It does not have to be complex. Smaller organizations, limited quantities of IP assets or narrow-scoped inquiries lend themselves to faster, simpler and less expensive audit planning and execution.

OBJECTIVE AND SCOPE. The audit plan should spell out the purpose of the audit: What’s driving the need for it? What does the company hope to understand at the conclusion of the audit? What decisions does it hope to make? What information is required to make those decisions?

AREAS OF INQUIRY. The individual or team conducting the audit should prepare a list of documents and information to be reviewed consistent with the agreed-upon scope of the audit. This would include IP assets themselves such as patents, trademarks, copyrights and trade secrets. It may also include “adjacent” or supporting information such as agreements and documents that can affect the rights associated with these assets. Depending on the scope as well as company size and complexity, the information looked at can include broader corporate information.

Following is one example of the areas that can be looked at in an intellectual property audit. Certainly not all apply in every instance, and more can be added. It is also often the case that the information requested might not be readily ascertainable; the auditor might need to excavate it. These inquiries might also lead an auditor to next-level questions or requests for information. Document or information requests can be further broken down into bite-sized pieces by asset class, by function, by area of inquiry:

- Pending home country and international patent/trademark applications and status

- Contact information for each

- Prosecution records for each patent and trademark (including office actions, allowances, opposition, interference, post grant, appeals, etc.)

- Issued patents and trademarks (with registration numbers)

- Contact information for each

- Any state registrations for trademarks

- Domain names, web sites, etc utilizing brand names/trademarks

- Maintenance or other fee status for each IP asset

- People or service in charge

- Ownership/inventor records & logs for each IP asset

- Assignment documents for each IP asset

- Pledge/security/collateralization records for each IP asset

- Litigation and pre-litigation (demands/cease & desist/settlement & release, etc.) records

- Prior art searches & records for each patent, and opinions (legal or otherwise) given for each, including strength, weakness, litigation exposure, validity of third-party patents, etc.

- List of products or services covered by or referenced by each IP asset

- Letters/faxes/emails from any third-party monitoring vendors

- Third-party inquiries about patent status & any other correspondence concerning each IP asset

- Third-party inquiries about license opportunities

- Any existing IP asset lists, including references in funding documents, insurance documents, series a-z stock offerings, business plans

- Royalty and related agreements / revenue streams for each asset

- Design and development agreements

- Standards organization agreements

- Reseller/distribution and related agreements

- Articles, data sheets, white papers, psa’s, marketing collateral, speech/webinar/presentation outlines and any other source that mentions or refers to company intellectual property or innovation

- Company documents regarding IP policies and procedures. Examples:

- Employee intake and exit procedures

- Invention disclosure/review workflows

- Cleanroom procedures

- Public announcement /public speaking policies

- Pre-incorporation written memoranda, agreements, diaries, inventions, other documents

- Formation documents

- Articles of Incorporation

- Organizational Minutes

- Bylaws

- Stock subscription agreements

- Board minutes & resolutions

- Investor term sheets/private placement memoranda/agreements

- Investor pitch decks

- Written business plan(s)

- Founder assignment & transfer agreements

- Company organization chart

- List of employees, dates of hire and IP-related intake documents

- List of terminated employees, dates of termination, and IP-related exit documents

- Employment agreements

- Noncompete agreements

- Nondisclosure agreements

- Invention assignment & disclosure agreements

- Work-for-hire agreements

- Non-solicitation agreements

- Summary of insurance agreements

- All written company policy, rule & procedure documents, manuals, handbooks, training materials, etc. (concerning employees as well as IP processes)

- List of outside service providers including printing, publishing, PR, marketing communications, ISP & web hosting, IT, data backup, application or data hosting and agreements

- List of vendors, service providers and contractors with on-site permissions, including maintenance, cleaning, food, beverage and other deliveries

- Building lease and related agreements

- Loan, securitization, collateralization agreements

Responsible Parties

The IP audit should include proper company authorization for the auditors themselves – execution of a nondisclosure agreement and corporate authorization. It is helpful, though certainly not required, if the audit can be performed by a lawyer or under the supervision of a lawyer, and delivered to or conducted under the auspices of a company lawyer. In this way, the attorney-client privilege is more likely to apply to the final report as an added measure of confidentiality. Individuals within the company – administrative, management, executive-level or other - should be identified for interviews. A main point of contact should be identified to clear bottlenecks and serve as a primary liaison to guide the auditor and help facilitate interviews and document production. This includes helping to clear a path to speak with outside counsel where necessary.

The audit is more likely to flow better and the results better understood with constant communication, minimal disruption of business operations, a clearly written report, and a thorough conclusory presentation.

FROM AUDIT TO IP MANAGEMENT

Intellectual property audits are snapshots in time. While the output is actionable in one way or another, it is still a moving target. New IP assets are created or acquired. Knowledge workers come and go. Business goals, organization and resources change. Assets die out, are divested, or are deployed in new ways. Intellectual property – and the innovation that leads up to it – must be actively managed. Business must be conducted at the speed of business. There are many stakeholders with different roles but with interests tied to the same intellectual property: Inventors, administrative workers, directors of innovation and R&D, lawyers and paralegals (in-house and outside), managers and VPs of intellectual property, marketing departments, finance, tax, compliance and licensing professionals. These are some of the constituencies as an idea travels its increasingly complex journey from inception to the money.

It is difficult to impossible to keep track of innovation and intellectual property activities manually, at least not without incurring unnecessary risk or missing out on opportunities that slip through the cracks. Most companies recognize that intellectual property drives innovation, creates and sustains value, and helps maintain a competitive edge. Still, most companies track IP using emails, file folders, banker boxes, spreadsheets, or suboptimal tools.

INSUFFICIENT APPROACHES.

- Docketing is not IP management. Docketing systems are legal tools to help companies ensure that they take appropriate actions by required dates. They do not help to determine whether these actions are sensible. For example, a company with hundreds of patents could be wasting thousands of dollars annually by maintaining patents that it does not use in its core business, but the docketing system does not care. It simply informs users that it is time to make certain payments or take certain actions.

- Spreadsheets are a Great Way to Propagate Errors. Spreadsheets are often used to try and make up for shortcomings in the functionality of docketing systems. Companies will try to track additional information about intellectual property. However, spreadsheets are error prone, difficult to share, and limited. A study quoted in CIO Magazine in 2007 found that, on average, four out of five spreadsheets contained errors.1 The article went on to describe a number of material spreadsheet blunders that cost the respective companies tens of millions of dollars. Not much has improved. See, for example, a 2014 piece at Forbes.com entitled “Sorry. Your Spreadsheet Has Errors (Almost 90% Do).”2

- Shared Directories Cannot Handle Complex Relationships. Shared directories on network servers or similar technologies are sometimes used in an attempt to overcome the inability of spreadsheets to be shared easily. Unfortunately, information kept in a shared directory requires a lot of maintenance in order to ensure that the data are current, and version control becomes a new problem. And although shared directories may be a convenient place to dump related bits of information, they are severely limited when it comes to handling key relationships — for example, between technologies and business units or between IP assets and products.

None of these approaches or any combination of the tools described here suffices for the meaningful implementation of intellectual property management. Consequently, many different spreadsheets, databases and directories are deployed in different areas of the company in an attempt to address needs at a departmental level. This creates a nightmare scenario of disparate data silos, each with its own risks of data inaccuracies and none with the complete business-oriented picture of the company’s intellectual property assets.

To deal with these shortcomings, industry consultants agree that companies must have IP management systems that:

- Sustain a repeatable process that spans multiple departments

- Can survive employee turnover

- Manage key variables for multiple types of intellectual property

- Move beyond prosecution/maintenance tools to address business-level needs

- Continually track and share information within the company regarding known and emerging competitive technologies and organizations

- Track and manage IP-related opportunities and agreements

TOOLS TO HELP

In the world of intellectual property management, there is no substitute for human judgment. An IP audit can reveal actionable information, but someone has to act. The temporary nature of an audit leads logically to the follow-on implementation of systems, tools and technologies to carry it forward and enable real-time management. Still, someone has to advise, manage and decide. But the key to an effective intellectual property audit, and effective ongoing IP management, is to reveal information that was previously hard to see; to enable fast and smart decisions. In other words, to increase efficiency so that workers are free to do what they do best. There are technologies that can help.

At a high level, IP management systems can support organizations in their efforts to:

- Create incremental corporate value;

- Increase competitiveness;

- Build additional revenue; and

- Reduce costs.

At a more practical, tactical level, good IP management systems help to better align a business with its IP activities by:

- Connecting various players together in one central, secure location;

- Automating repeatable processes;

- Providing instant visibility to key data.

The following are some of the features to look for.

AUTOMATED WORKFLOWS AND TEAM COMMUNICATION

One of the biggest efficiency challenges for innovation teams is communication. Because there are so many players involved in procedures like invention disclosure (e.g. inventor, admin, in-house attorneys, outside counsel, review boards, etc.), a lot of time goes into basic meeting coordination and drafting correspondence.

Typically the stages of invention disclosure and related IP management processes are straightforward and thus lend themselves to automation. IP management systems speed up these processes with repeatable forms generation, automatic notifications and alerts (“ID just submitted,” “More info needed,” Ready for Review,” “Approved for filing,” etc) and simultaneous next-step actions.

RELATIONSHIP MAPS

It is ironic that intellectual property is such a profit driver for most companies yet it is so hard to see the ecosystem that comprises the value. In order to efficiently leverage the creation and exploitation of IP, a company should know:

- Who are the most prolific inventors?

- What products have sprung from their invention disclosures?

- What are the patented technologies and other intellectual property assets contained within each product or service?

- What are the most IP-rich divisions within the company?

- Which of the company’s IP rights are connected to licensing agreements?

A good IP management system can answer these questions and more with solid inventorying and categorization capabilities. Some systems make these associations even easier to understand by generating a visual web, also known as a relationship map. These representations allow management and other team members to quickly see how their IP is organized and deployed which in turn helps them audit the inventory at any given time or otherwise track performance.

These and other relationships inform strategic actions and speed up decision making. As importantly, inventors are more likely to make sure the can gets kicked down the road if they can track the status of their invention disclosures. Visibility into how the parts connect to a whole keeps people engaged and excited.

LEGAL SPEND MANAGEMENT

There are some IP management tools that are geared mainly for legal professionals. The systems that are more business-oriented still recognize that companies almost always partner with outside counsel – as a part of the invention review process, or for IP registration, protection, renewals and litigation. This is often a significant part of an IP budget. Tracking costs, managing payments, and evaluating the effectiveness of those partnerships is important. Some IP management tools can provide a listing of spend by law firm, the work they performed, which asset the work was associated with, and the efficiency of outside counsel’s time in relation to results. With that information, businesses can make more precision-oriented budgeting decisions.

DATA VISUALIZATION

IP management systems that feature data visualization tools and graphical dashboards make tracking and acting on information a much simpler process. They also provide powerful insights such as increases (or decreases) in the company’s invention output over time and other goal-oriented data, and make for powerful reporting – to managers, boards and others.

1. https://www.cio.com/article/2438188/enterprise-software/eight-of-the-worst-spreadsheet-blunders.html

2. https://www.forbes.com/sites/salesforce/2014/09/13/sorry-spreadsheet-errors/#2601188156ab

SUMMARY

Given the importance and value of intellectual property to most companies, IP audits are effective starting points for aligning a business with its IP activities. Even event-driven IP audits can serve the dual purpose of serving the triggering event but also highlighting gaps and strengths, revealing hidden value and inspiring follow-up actions. There is invariably room for improvement in most organizations to do a better job of identifying and leveraging their intellectual property. Those who pay closest attention and avail themselves of best practices will be those who thrive in a competitive global knowledge economy.

APPENDIX

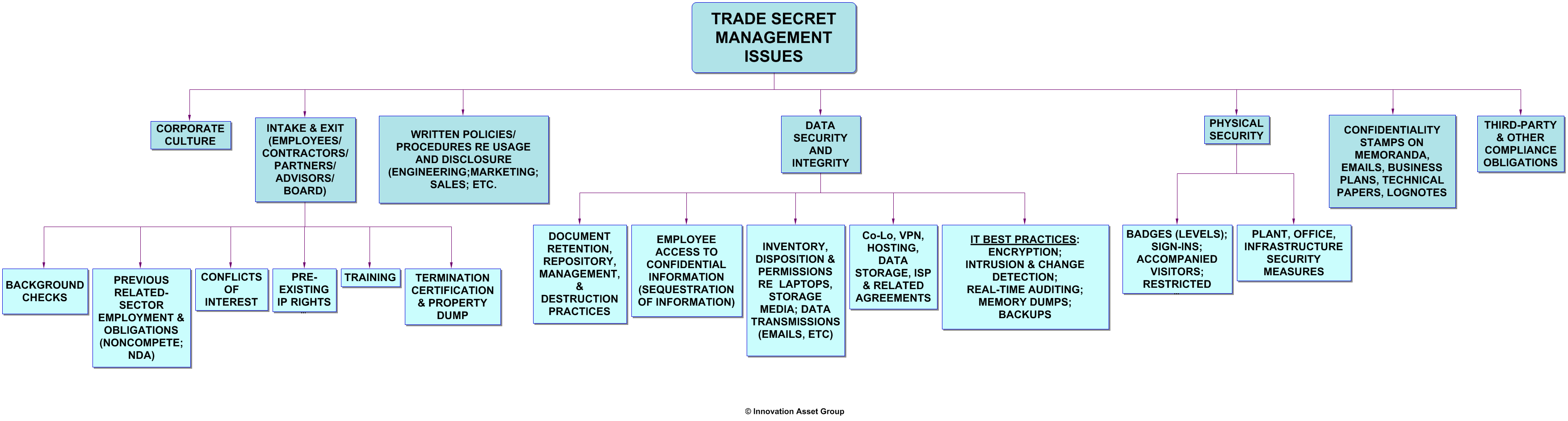

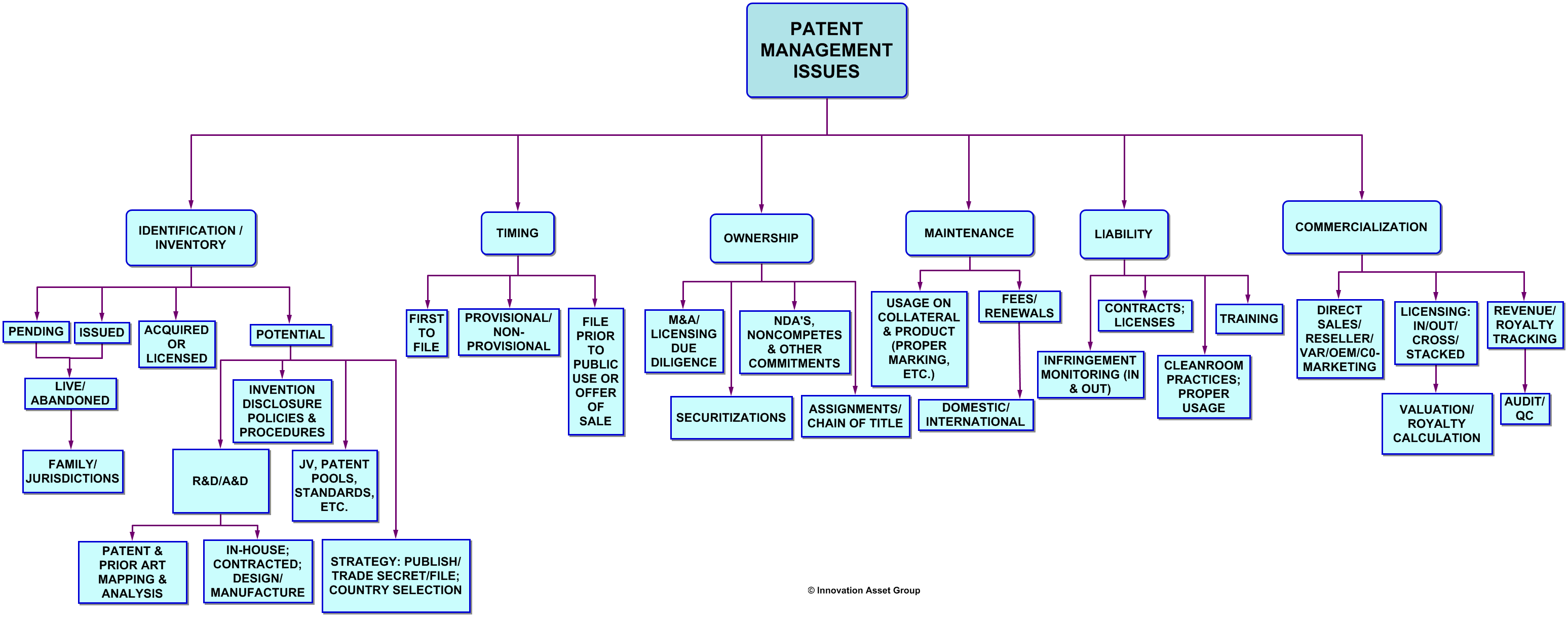

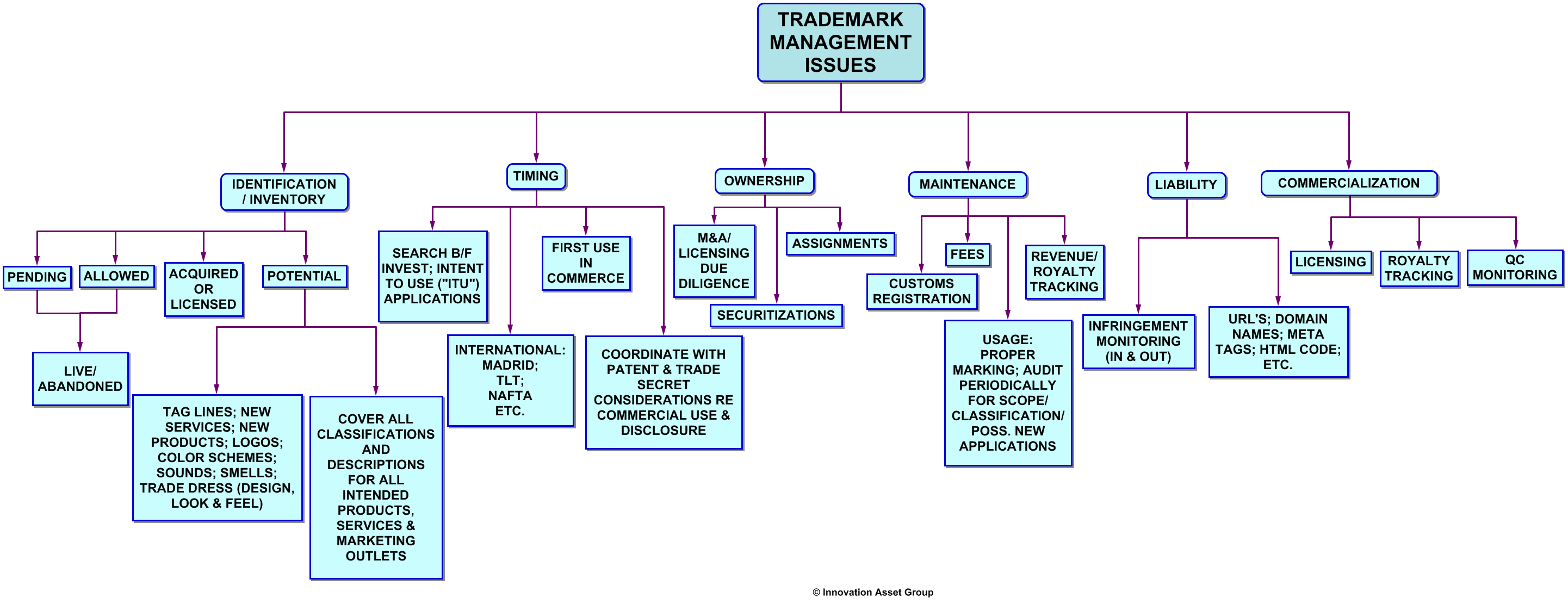

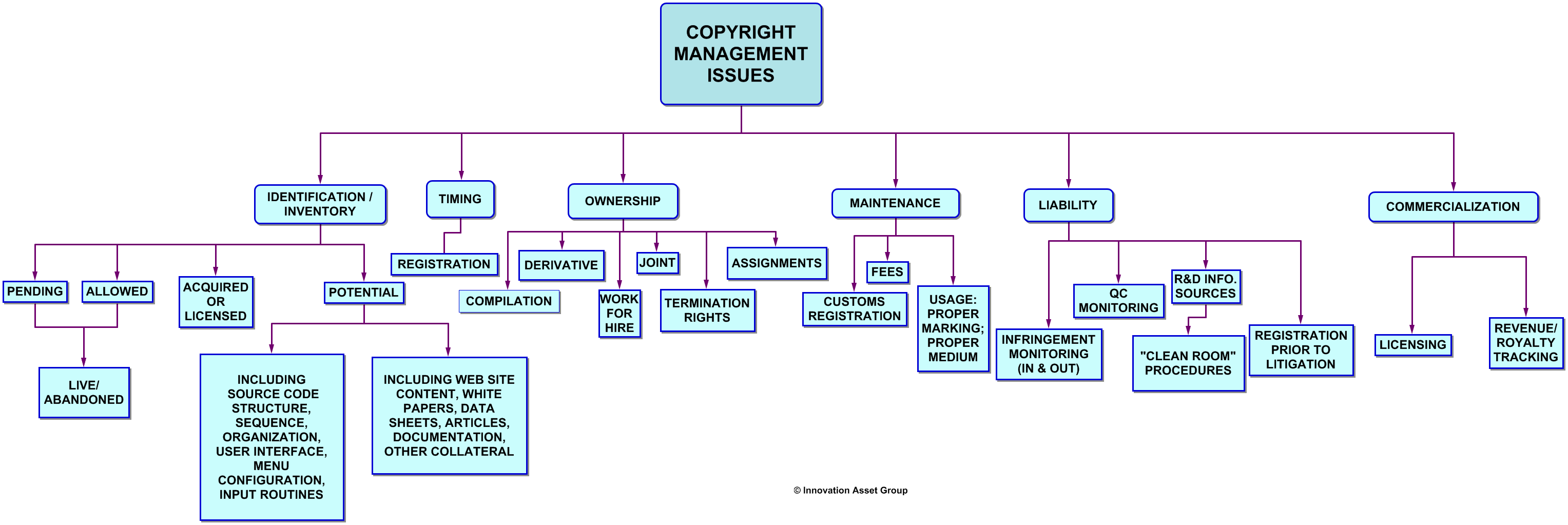

Broken down by asset class, one way to view intellectual property management issues is as follows. Note this is not a complete list of every issue, and different industries might have nuanced regulatory, statutory and case law interpretations.

PATENTS

TRADEMARKS

COPYRIGHTS

TRADE SECRETS